Global Impact Pool Quarterly Investor Letter

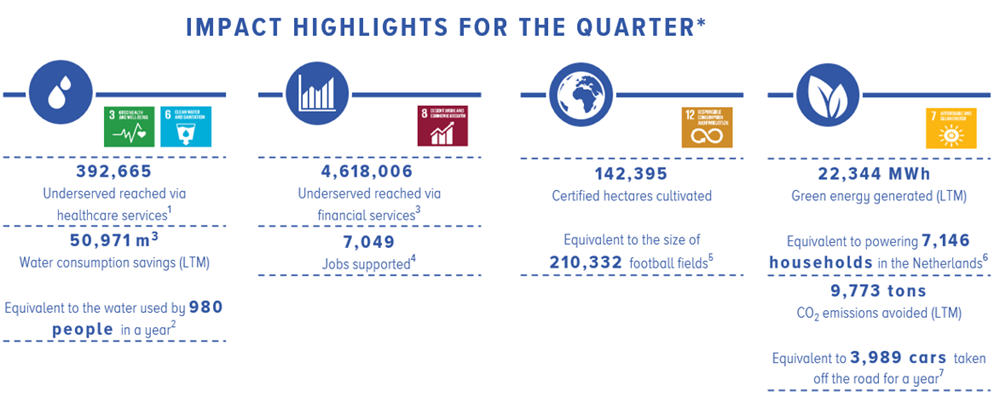

Specifically, we aim to address the following impact themes:

- Basic needs & well-being: the provision of basic goods & services for the underserved including water and health & wellbeing;

- SME development & decent work: creating decent jobs with fair employment practices to eradicate poverty;

- Circular economy: Support sustainable consumption and production aimed at doing more and better with less, and;

- Climate & energy: Contribute to abundant clean energy and reduction of CO₂ emissions.

Bearing in mind our mission, there is also the explicit target to generate a market rate financial return.

Impact highlights

Financial return

The Kempen Global Impact Pool (GIP) achieved a return of 4.7% for the FA share class during the second quarter of 2022, resulting in a YTD return of 3.9%. The return over the last 12 months amounts to 21.9%, while the average annualized return over the last 3 years is equal to 6.9%. Since the launch of the fund in the beginning of 2018, the fund realized an average annuallized return of 4.6% for its participants.

The positive momentum of the fund in 2021 continued during this second quarter of the year. The core impact investments in Private Equity and Venture Capital delivered strong returns mainly as a result of valuation uplifts at the underlying company level and a tailwind from the strengthening US dollar, the result from the global nature of GIP’s investment portfolio. The GIP’s infrastructure allocation, which focuses on European greenfield renewables projects, also realized decent returns as developed assets in solar and wind energy are increasingly becoming operational and are starting to generate revenues.

Portfolio development

The GIP continued its mission to pool capital and scale impact on behalf of its participants during the second quarter of 2022. Assets under management increased to €166 million at the end of June 2022. This increase can be attributed to an increase in the value of the investment portfolio and a significant inflow of client assets. On a net basis, there have been inflows of approximately €12 million for the GIP during the second quarter of the year.

During the second quarter of 2022, the team has been successful in deploying a significant amount of new capital. Throughout the quarter, capital was called by most of our investment partners, with EIF (US venture capital - energy transition and circularity) and Trill Impact (Northern Europe Private Equity - broad impact mandate) accounting for the majority called. Also, at the end of the second quarter, the GIP has committed fresh capital to a new fund raised by our partner LeapFrog, which is investing in companies that (1) fuel financial inclusion and (2) provide essential health services to low-income customers in underserved, emerging markets.

GIP’s investment team has further enhanced its promising pipeline with new investment opportunities, the majority of these opportunities reside within the Climate and Energy impact theme.

The overview below provides a summary of the most important developments in the portfolio this quarter per individual impact theme.

Investments within the theme of SME development and decent work developed well during the quarter. During the second quarter of 2022, Quona Capital, focusing on early-stage fintech companies in underserved economies, provided additional capital to several existing portfolio companies. Some examples include ZestMoney, Global66, Julo and Sokowatch, all these companies perfectly align with GIP’s goals for financial inclusion in emerging markets by providing essential insurance and health services to low-income customers. Zestmoney is a provider of short-term unsecured credit to undeserved consumers for making digital cardless online and offline point-of-sale purchases. Global66 focuses on Latin American markets where it offers a cross-border money transfer platform to its consumers, allowing migrant workers to transfer funds back home at lower costs compared to services offered by incumbents. Underserved consumers in Indonesia can use the services of Julo for taking short-term and relatively small loans at affordable rates. Sokowatch operates in Africa, where it focuses on providing fast-moving consumer goods delivery and credit to, often informal, micro, small & medium sized local enterprises (MSME’s).

Leapfrog has completed a follow-on secondary investment in PasarPolis, a leading insurtech player in Indonesia. This firm operates as a digital insurance broker that provides modular and embedded insurance to end-consumers, merchants and partner platforms in an affordable way. The company has expanded its business to Vietnam and Thailand in the last few years and has experienced significant growth since the firm was added to the investment portfolio of the GIP.

Timor and Bangladesh are notable examples. Other loans were disbursed to cashew nuts producers operating in Togo and Burkina Faso in the Sub-Saharan Africa region.

The GIP also increased its exposure in For Days, a direct-to-consumer manufacturer of essential clothing. The company aims to create a popular brand of basic clothing with a highly sustainable production process and, most importantly for this theme, a closed loop system in which used clothes are recycled into new apparel.

With its investments within the Climate and energy transition theme, the GIP contributes to the transition to more sustainable energy sources. KGAL, with currently two funds in GIP’s portfolio, invests in the development of wind farms and solar energy parks. KGAL continued to make good progress during the quarter, as again a significant amount of additional capital was called causing the exposure of the GIP to the Climate and energy theme to increase. This capital was used, among other things, to provide additional funding to an offshore wind farm in the German North Sea (Veja Mate), and solar power plants in Portugal and Italy. These investments will soon add a significant amount of renewable energy capacity to the energy network. We can also already share that, after the end of the second quarter, the GIP committed significant additional capital to KGAL’s latest fund which reflects our conviction in this investment partner and its exciting pipeline of projects.

EIF added two new exciting companies to the portfolio during the quarter. Capital was called for an investment in Ambient Photonics, a company with the aim to bring low light energy production technology to scale. The company produces photovoltaic cells which can generate energy from e.g., LED, fluorescent or diffuse sunlight, and therefore can be a replacement for batteries in e.g. (small) home appliances. EIF also invested in Vibrant Planet, this company uses cloud-based technology and data-driven science to make its consumers more resilient in light of climate change. An example of a service is a planning and monitoring tool for adaptive land management systems with the goal of restoring the ecosystem.

The impact case for this quarter focuses on Aviom Housing, an investee in the loan portfolio of the Northern Arc India Impact Fund. Aviom Housing has developed and designed a model that allows it to provide affordable and easily accessible housing finance loans to low-income individuals and families in India.

There’s a saying in Dutch, Kom verder, it means many things and it’s our business philosophy. It captures the way we work with clients but also the way we steer our investee companies to deliver shareholder value through active engagement.

Capital at risk. The value of investments and the income from them can fall as well as rise, and investors may not get back the amount originally invested. Past performance provides no guarantee for the future.