Different risks, same culprit – Inflation

Written by Robert Scammell, Director Client Portfolio Management UK

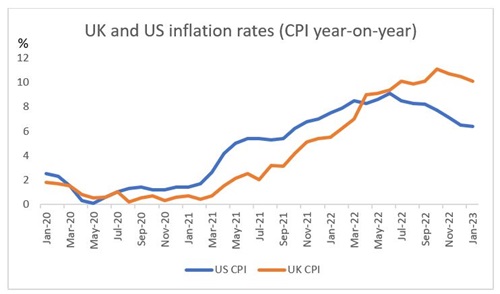

Inflation has been falling in developed markets since the end of last year. In the US, progress has recently stalled despite significant monetary tightening and in the UK, while inflation itself remains elevated, the outlook for it is perhaps slightly better; peaking at 11% in October 2022, it has since fallen to 10% and is expected to continue falling over the next year with financial markets anticipating CPI inflation being around 3% by February 2024.

Graph 1: UK and US inflation rates

Source: Bloomberg

The reasons for the fall in UK inflation are manifold but can be boiled down to two key influences.

Firstly, to state the somewhat obvious, for inflation to go up prices need to rise! In 2022, there were several one-off factors that compounded the inflation we saw in 2021 following the pandemic. Most notably, extremely high energy costs. Even if energy prices remain stable rather than falling this year, their impact on inflation will drop – we do not need energy costs to go down, we just need them not to go up by the same amount they did in 2022 in our battle to tame inflation.

The second reason is that UK growth is expected to be extremely low over the next few years with BoE estimates suggesting that growth will be negative in 2023 and 2024, and under 1% in 2025 and 2026. This anaemic growth will impact the demand side of the economy, thereby having a moderating impact on inflation.

Whilst markets and the BoE agree on the very near-term path of rates, both fundamentally disagree on the path over the next 2-3 years. Whilst the BoE expects inflation to continue falling in 2025, settling at 1% in Q1 2025, this is at odds with markets that see inflation settling at 3% over the medium term. This divergence stems from a difference in views. While the BoE expects weak growth in the UK to put downward pressure on inflation, markets are more likely focusing on the very strong labour markets and pay rises which they contend are not consistent with 2% inflation.

Given it is currently the single biggest driver of financial market pricing, it is also worth examining US inflation despite its lesser direct impact on UK pension investors. CPI inflation peaked in June 2022 at 9% and has since fallen to 6.4%, the three month figures to January 2022 showed the slowest pace of increase since the start of 2021 as lower commodity price declines started to feed through. However, core prices, which exclude volatile food and energy components, have accelerated for the past two months with the main source of inflation now being the service sector that is more exposed to labour costs. This indicates there has been second order impacts where prices rise beyond those sectors initially impacted and which make inflation harder to bring under control.

However, recent data also shows that the pace of the decline in inflation is slowing and that despite significant increases in interest rates, the US labour market and consumer spending remain strong. Indeed, recently released PCE shows yearly inflation accelerating between December and January.

This resilience in the face of repeated rate increases has led financial markets to rapidly reprice where they see the future path of policy rates, with expectations for the terminal policy rate having increased 4.9% at the end of January, to 5.4% currently. This repricing of US rates has not yet led to a significant revaluation of equities, though there has been some weakness, however, the room for manoeuvre in raising rates further, moving inflation to target and not impacting corporate profits is extremely tight.

For pension funds, whose liabilities typically stretch out for decades, short-term moves in inflation, whilst interesting, have a limited impact on funding levels. The biggest risk therefore is that there is increasing commentary around how it is simply not possible to return inflation to 2% without causing recession and a dramatic decline in living standards that central banks to not have the risk appetite for.

One potential response therefore could be to reframe inflation targets such that they allow central banks to focus more on growth and allow inflation to runs structurally higher – perhaps at 3%. This would have a far more substantial impact on pension schemes than short-term fluctuations in the inflation rate, and whilst it is not likely at the moment, the one lesson we have certainly learnt over the years is that things that we once regarded as being unlikely have a way of happening.

Another potential issue is that as real rates increase the risk of collateral calls also increases. Up until very recently, equity markets have been relatively sanguine about rising rates but, with the release of the PCE data last week, the dam appears to have broken. Further rises in real rates are likely to push equity valuations down, meaning that if collateral calls do occur, there could be forced selling of equities at a very importune time.

Van Lanschot Kempen Investment Management (UK) Limited (VLK IM) is a company registered in England and Wales with company number 02833264. Van Lanschot Kempen Investment Management Ltd is authorised and regulated by the Financial Conduct Authority (“FCA”) with Firm Reference Number 166063.

Registered office: Octagon Point, 5 Cheapside, London, EC2V 6AA.

There’s a saying in Dutch, Kom verder, it means many things and it’s our business philosophy. It captures the way we work with clients but also the way we steer our investee companies to deliver shareholder value through active engagement.

Capital at risk. The value of investments and the income from them can fall as well as rise, and investors may not get back the amount originally invested. Past performance provides no guarantee for the future.