How to close the SDG gap

Background

The UN Sustainable Development Goals (SDGs) were adopted by the United Nations in 2015. They are a universal call to action to end poverty, protect the planet and improve lives, underpinned by 169 targets that we collectively need to work towards by 2030.

The SDGs can primarily be split into those more focused on the environment (like climate change, biodiversity, or natural resource management) and those on social issues (gender equality, health, empowerment, or decent work). Companies can contribute to some SDGs through their operations (i.e. paying fair wages, having an inclusive human capital policy), or through providing products and services that help achieve the SDGs (i.e. renewable energy, affordable healthcare, bio-based pesticides).

It is estimated that meeting the SDGs requires US$5 trillion to US$7 trillion in investment each year from 2015 to 2030, which current investment levels significantly fall short of.

We need to close this ‘SDG Gap’.

Closing SDG Gaps

The distance we need to cover to close the gaps on the 169 targets differ per topic, industry, stakeholder group or geography. Although all targets are equally important, not all of them are equally investible. Global, timely and complete datasets are hard to come by.

Significant effort goes into measuring the contribution to 'closing the gap' every year.

The Organization for Economic Cooperation and Development (OECD) has undertaken a study to see how far OECD member states are from closing the gap on the SDGs, but while this is useful, the biggest sustainable development gaps exist in the non-OECD, less well-off countries. An open-access resource on this gap is the SDG tracker website or the annual progress update by the UN Department of Economics and Social Affairs (UN DESA).

We have seen some progress. The share of the world’s population living on less than $1.90 per day recently fell below 10% for the first time according to the World Bank (SDG 1: No poverty) and, as shown in Figure 1, the proportion of renewable energy used in final energy consumption has grown steadily between 2010 and 2017 – ( SDG 7: Affordable and clean energy)

However given the resources, technology and capital available right now progress towards the Goals remains too slow, and the impact of the Covid-19 pandemic is causing extreme setbacks. The Covid-19 impact is also disproportionately higher on more vulnerable regions.

Figure 1: Growing portion of renewable energy in final energy consumption (2010, 2017 in %)

Source: UN DESA 2020 SDG Progress report

Investors must prioritize themes and outcomes

The private sector, including investors such as Van Lanschot Kempen (VLK), has a critical role to play in achieving the SDGs. However the SDGs are so wide-ranging that it is important for organizations to focus on where their contribution can be most meaningful if impact is going to be measurable and maximized. Investors need to determine which themes they will prioritize and establish what success means for them in the listed and non-listed asset classes.

In the listed asset classes this can start by seeking to have portfolios that on a high level perform on the SDGs better than the benchmark. In this case, investors might select companies that already perform well both in terms of their operations (having high ESG standards) and also generate a certain proportion of their revenues from products and services aligned with the SDGs. Another threshold for the ambition might be to establish what percentage of revenues investee companies should derive from SDG-aligned products and services (such as renewable and affordable energy, nutritious food or energy efficient buildings).

Investors also need to ask themselves, what they are not going to do. For example, what are the exclusion thresholds they will apply to their SDG-aligned investment solutions?

An additional commitment from the investor's side is to engage with companies who may not yet be frontrunners when it comes to sustainable development, but have the potential to become ones. Companies are more likely to prioritize Capital Expenditure (CapEX) and R&D aligned with the SDGs if they are also reassured by their investors that this should be a priority.

Van Lanschot Kempen focus areas

VLK’s thematic focus is on the three areas of: climate and energy transition, smart and circular economy, and health & wellbeing. Issues such as biodiversity or inclusiveness are linked to these topics and the opportunity to contribute to decent work and economic development (SDG 8) is a red thread connecting them all. This focus comes in addition to VLK’s overall commitment to avoid doing harm and promoting responsible business conduct.

Figure 2: VLK’s three SDG focus areas

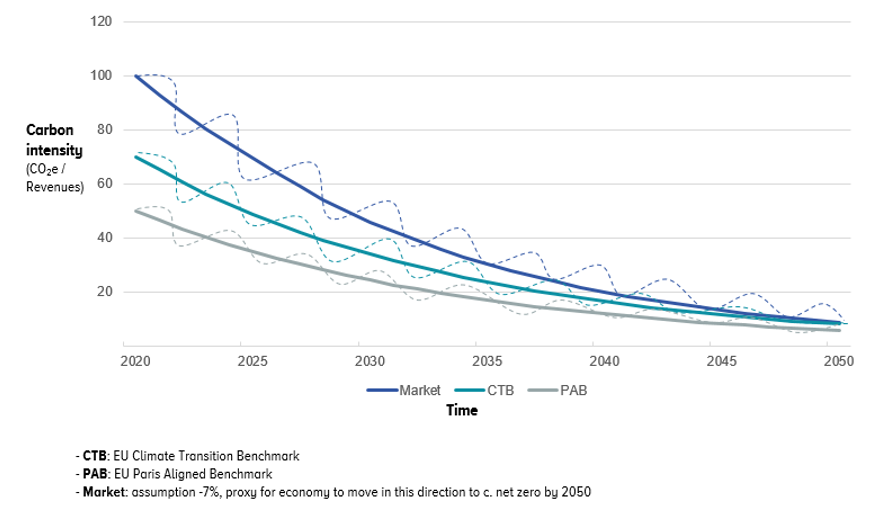

As a long-term investor, we believe climate change represents a systemic risk facing the economy, society and environment, and we want to consider the risks and opportunities this presents to our investments in the coming decades.

Our new Climate Change Policy has set a long-term commitment to become a net zero investor by 2050, as well as short-term objectives to align with a Paris Agreement pathway for listed investments by 2025, and non-listed by 2030.

Figure 3: The EU climate pathways to achieve net zero ambitions

SDG data & measurement

At VLK we want to assess the SDG alignments of our investments and be fully transparent about our rationale. Unlike other investors we measure both the positive and negative contributions of investees and take care to avoid using insubstantial data, which could lead to greenwashing.

In our experience the methodologies and underlying taxonomies of those who provide SDG-related data differ considerably with the coverage and robustness of the information varying across funds, ESG themes and sectors. For example, there is a significant proportion of goods and services that currently are not effectively identified as either contributing to or obstructing achievements of the SDGs.

Last year we made good steps to start assessing the SDG alignments of our investments per million EUR invested, to make comparisons more consistent, and started working with new data provider for the listed asset classes. Together we looked for meaningful ways to bring the measurement of SDG alignment into the heart of our investment decision-making. This means that funds such as our Global Sustainable Equity Fund now allocate scores based on the percentage revenue a company contributes to individual SDGs in terms of products and services.

On certain themes, such as climate, SDG data is much more advanced than on other themes. This is reflected in the revenue alignment score. Companies often do not report in a sufficiently detailed way about their revenues per products aligned with the sustainable development themes, therefore their revenue percentages are estimated.

In conclusion

At VLK we believe that what gets measured gets managed and our transparency enables us to make conscious decisions with a clear rationale. This commitment is very much aligned with our mission to be long-term stewards, enabling our clients to preserve and create sustainable wealth with real economic returns and with positive environmental and social impact.

To find out more about our Global Impact Pool, which invests in non-listed asset classes specifically to help achieve SDG goals, please contact us.

Disclaimer

Van Lanschot Kempen Investment Management N.V. (VLK IM) is licensed as a manager of various UCITS and AIFs and authorised to provide investment services and as such is subject to supervision by the Netherlands Authority for the Financial Markets. This document is for information purposes only and provides insufficient information for an investment decision. This document does not contain investment advice, no investment recommendation, no research, or an invitation to buy or sell any financial instruments, and should not be interpreted as such. The opinions expressed in this document are our opinions and views as of such date only. These may be subject to change at any given time, without prior notice.There’s a saying in Dutch, Kom verder, it means many things and it’s our business philosophy. It captures the way we work with clients but also the way we steer our investee companies to deliver shareholder value through active engagement.

Capital at risk. The value of investments and the income from them can fall as well as rise, and investors may not get back the amount originally invested. Past performance provides no guarantee for the future.