Why active is attractive: the case for engagement

At Kempen, we wholeheartedly believe in active portfolio management: the road to a sustainable future is not paved with gold, but with good guidance. For over twenty years, we have taken a proactive approach focused on deep engagement and long-term stewardship - which we call The Real Active. We engage with both large and small cap companies to help stimulate and improve their operations in a way that leads to positive social, environmental and financial outcomes.

Active management methodology

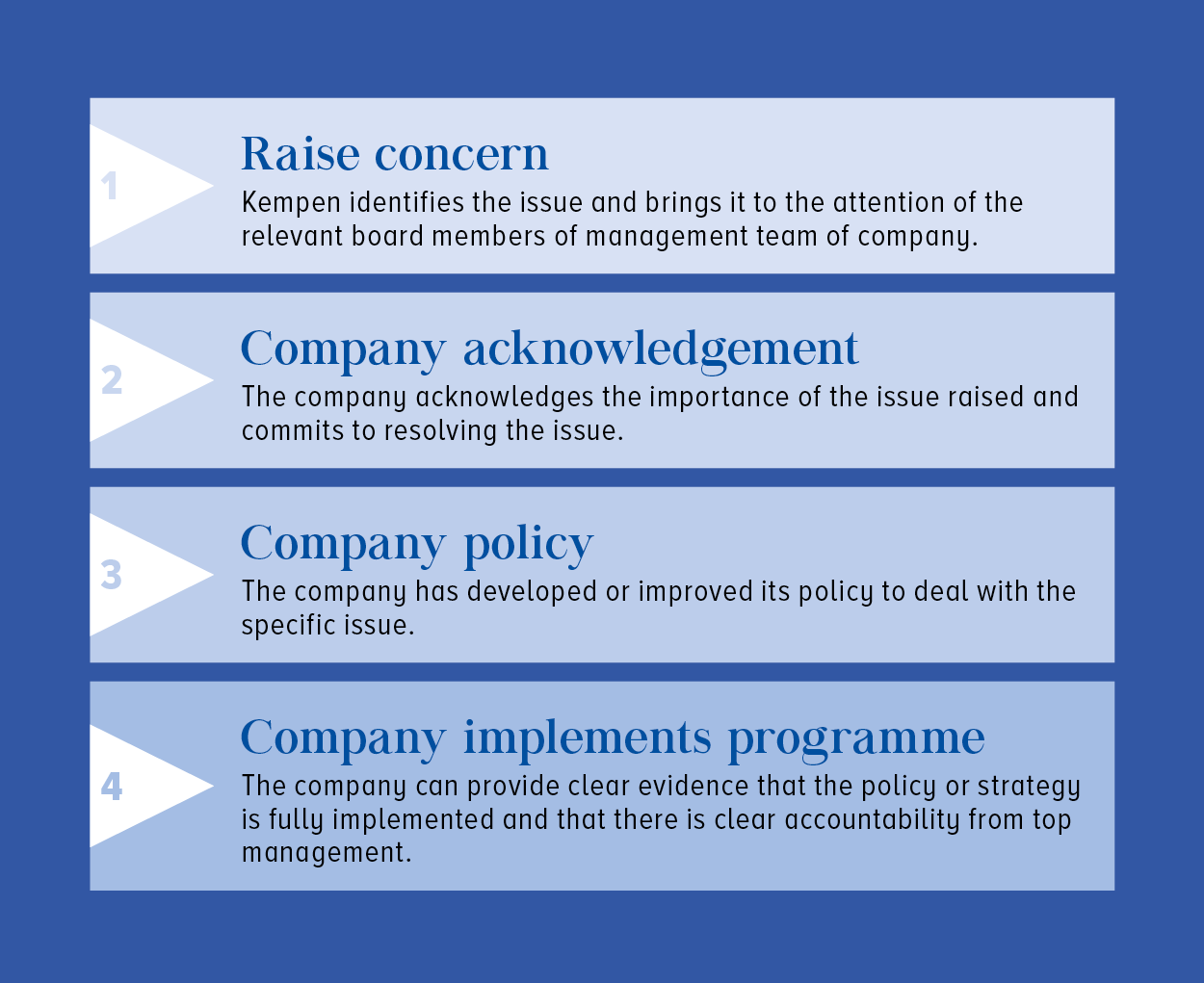

Firstly, we are not content with engagement for the sake of it. In order to ensure the impact and success rate of our engagement efforts, we set clear goals and timeframes (see figure) and have an aim to move every engagement at least one milestone further every six months.

In 2021, we focused more frequently on environmental and governance issues than on social, with climate change being the most significant topic at hand. You can read more on our approach in Kempen’s Annual Stewardship and Sustainable Investment report.

Figure 5: Milestone Methodology

Source: Kempen 2021

It’s not just about us

Part of our approach is looking holistically at challenges, such as the low-carbon transition, and engaging in a way that drives down real-world emissions, not just the emissions in our portfolio.

The steel industry, for example, contributes around 8% of global greenhouse gas emissions and it would be very simple for Kempen to simply divest from this industry and claim we were doing the right thing. However, we also recognise that steel is a critical part of the global economy and that we need it to build renewable energy structures, such as wind turbines and solar panels.

As a result, we have a long-term investment and engagement strategy with companies, such as with Befesa. Befesa is a global market leader in treating industrial waste from the steel industry. Befesa plays a crucial role in the production of steel from recycled scrap, which in itself is more sustainable than using iron ore for primary steel production. Producing recycled steel requires up to seven times less CO2 compared to primary steel production. Befesa has a capacity to recycle 999,000 tonnes of steel dust annually, saving on the emissions that would be created by producing primary steel.

Acting as a long-term engaged shareholder, we have been able to help Befesa identify and implement improvements, so that the company’s ESG rating with Sustainalytics was upgraded from Medium to Low ESG risk. As we have continued to engage with Befesa to drive for continuous improvement, Befesa committed to enhance its upcoming sustainability report, thereby addressing carbon emission reduction initiatives and corresponding target setting.

Engaging both small and large companies

The roots of our company are in active ownership, as our very first investments involved working closely with Dutch small caps. By their nature, small caps are well-positioned to benefit from engagement. Kempen as an investor can wield influence to pivot their businesses towards working more sustainably.

When engaging with Fujitec for example, a Japanese producer of elevators and escalators, we found the company was repeatedly underperforming on areas such as corporate governance and stakeholder communications. After years of continuous constructive engagement behind closed doors, which turned out to be only partly effective, we took the unusual step of publicly calling on the Board of Directors to take action. Following this we were encouraged by Fujitec’s commitments, with planned improvements on capital allocation and corporate governance scheduled to strengthen its competitiveness, thereby benefiting all stakeholders.

Engaging with some of the largest global multinationals requires a different approach - for example it may require collaboration with like-minded investors - but can be equally impactful.

We currently act as lead and supporting investors on several engagements for Climate Action 100+, the world’s largest shareholder engagement, and following efforts with Royal Dutch Shell in April 2020, the company radically updated its climate strategy to more closely align with the Paris Agreement and move towards a net-zero emissions energy business by 2050 – a plan we continue to monitor closely.

Similarly, we saw change at British threads supplier Coats Group following a Kempen engagement. The company has accelerated its approach to living wages, and in 2021 took action to bring salaries for employees in four countries up to living wage levels.

If engagement doesn’t work, we are willing to pull our capital

Kempen believes in the power of active management, but when shareholder engagement does not bear the results required, we are not afraid to divest. Following years of attempted engagement for change with Exxon Mobil, for example, Kempen divested its $28.98 million stake, as we deemed their climate policies to be “too little too late”.

In a similar vein, aside from its devastating humanitarian impact, Russia’s invasion of Ukraine and the subsequent economic sanctions have had a ripple effect across the globe, causing huge spikes in energy prices and severely affecting industry directly. Although Kempen’s portfolios have little investment in the Russian economy, we are willing to abide by such actions to ‘squeeze the Kremlin out’. In this way, the freezing of assets or complete divestment may be considered a necessary strategy.

Active asset management makes a difference: to our people, companies’ personnel and to the planet. Responsible investment is at the core of our strategy and long-term engagements enable us to have skin in the game, influencing the approach companies take towards sustainability with a view to making significant, meaningful change.

Disclaimer

Kempen Capital Management N.V. (KCM) is licensed as a manager of various UCITS and AIFs and authorised to provide investment services and as such is subject to supervision by the Netherlands Authority for the Financial Markets. This document is for information purposes only and provides insufficient information for an investment decision. This document does not contain investment advice, no investment recommendation, no research, or an invitation to buy or sell any financial instruments, and should not be interpreted as such. The opinions expressed in this document are our opinions and views as of such date only. These may be subject to change at any given time, without prior notice.

The value of your investment may fluctuate. Past performance provides no guarantee for the future. The figures presented are gross performance, the effect of potential fees and charges is not included. The level of the fees and charges will depend on the applied product structure, this will have effect on the net performance.

There’s a saying in Dutch, Kom verder, it means many things and it’s our business philosophy. It captures the way we work with clients but also the way we steer our investee companies to deliver shareholder value through active engagement.

Capital at risk. The value of investments and the income from them can fall as well as rise, and investors may not get back the amount originally invested. Past performance provides no guarantee for the future.