What does a good cop look like?

This summer the latest assessment report from the scientists of the IPCC ratcheted up the strength of their language and the urgency of their findings, showing there is no longer any shadow of a doubt connecting human activity with unprecedented global warming.

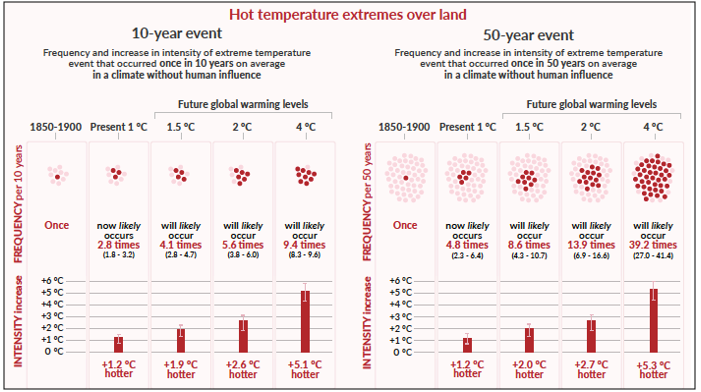

The analysis examined 5 different potential scenarios around the warming of the planet over the coming years. Every single one of these scenarios suggested that the Earth will reach at least 1.5C of warming in the next 20 years. “With every increment of global warming, changes get larger” concluded the IPCC, compounding the likelihood of extreme weather events such as this summer’s heatwaves and hurricanes in Europe and the US respectively (see image).

Figure: IPCC findings how the frequency of extreme weather may increase with each degree of warming

The alarming IPCC report serves as the underlying scientific basis for next month’s COP26 summit. So, what sort of outcomes should responsible investors be looking for in Glasgow? We suggest three fundamental outcomes are needed. Read our ESG newsletter to learn more.

Disclaimer

Kempen Capital Management N.V. (KCM) is licensed as a manager of various UCITS and AIFs and authorised to provide investment services and as such is subject to supervision by the Netherlands Authority for the Financial Markets. This document is for information purposes only and provides insufficient information for an investment decision. This document does not contain investment advice, no investment recommendation, no research, or an invitation to buy or sell any financial instruments, and should not be interpreted as such. The opinions expressed in this document are our opinions and views as of such date only. These may be subject to change at any given time, without prior notice.

The value of your investment may fluctuate. Past performance provides no guarantee for the future. The figures presented are gross performance, the effect of potential fees and charges is not included. The level of the fees and charges will depend on the applied product structure, this will have effect on the net performance.

There’s a saying in Dutch, Kom verder, it means many things and it’s our business philosophy. It captures the way we work with clients but also the way we steer our investee companies to deliver shareholder value through active engagement.

Capital at risk. The value of investments and the income from them can fall as well as rise, and investors may not get back the amount originally invested. Past performance provides no guarantee for the future.