Kempen Global Listed Infrastructure: Quarterly update

Key takeaways

- Slowing economic growth - we expect those companies which are able to demonstrate resilient growth to command a valuation premium.

- Rising interest rates - will lead to more focus on near term cash flows over longer term cash flows, as well as more attention on near term refinancing risk.

- This is the time for active portfolio management as bottom up analysis. Understanding a company’s growth trajectory and its gearing, will be a more material driver of stock prices.

Oppotunities in slow growth...

Market volatility was significant in Q3 2022. In the second half-year of 2022, markets started positively as 22H1 earnings and guidance was better than feared by investors, while the US FED was more dovish than expected. Although the trend continued initially in August, the hawkish comments of FED chair Powell returned. It sent indices lower, with the pace accelerating in September. The worries about inflation, more aggressive rate hikes, and recession, dominated markets again.

Looking forward - How to find good investment opportunities in a slowing economy? We believe economic growth will likely be muted in the years to come as Central Banks will aggressively raise interest rates to fight inflation. Already stretched government balance sheets (to offer support during COVID and the current energy crisis) will hinder legislators to support the economy effectively with the cost of borrowing going up.

Rising real rates to constrict economic growth

The last decade, we have seen a monetary policy led upcycle with low interest rates followed by QE and other interventions. Real rates fell into negative territory during the COVID pandemic as the Central Banks were reducing rates to stimulate the economy. The low rates have resulted in a high-risk premium,which was a tailwind for income-orientated asset classes as investors are forced up the risk curve in search of yield. The multiple expansion has pushed up share prices significantly in the last decade.

Following an extensive period of accommodative monetary policy, in which growth was limited, the economic recovery gathered steam with the opening of the economy post pandemic. Supply chain challenges, labour shortages and geopolitical uncertainty have pushed up inflation, and the latter was more structural than most expected.

Inflation has led to rate hikes and financial tapering by Central Banks, resulting in higher rates. Nominal rates started to increase in 2020, yet real rates remained stable in negative territory until summer this year. Since then, real rates jumped expecting Central Banks to aggressively lift main interest rates and reduce its balance sheet to bring inflation closer to its long-term target.

Real rates impact the borrowing costs for companies and households, while it triggers a higher discount rate to value assets – diminishing part of the benefits from the fall in cost of capital and rerating of yields.

Graph 1: Global Listed Infrastructure vs Real Rateshallo

Source: Kempen, FactSet, Oct-22

How to position – reduced reward for risk

Although the correlation between the performance listed infrastructure and rising real rates has not been higher than broader equities, infrastructure companies are not immune to rising real rates. Future growth will be discounted at higher interest rates going forward. As a consequence, the value of future investment projects shrinks. Furthermore, existing long duration infrastructure with limited growth should struggle as their value is sensitive to interest rate moves.

As the interest rate curve has steepened recently, one may have expected that companies with more cyclical infrastructure assets, such as transport infrastructure and energy transport, were expected to outperform as they should benefit from stronger economic growth and inflation. However, aggressive tightening of Central banks will have its economic impact – increasing the likelihood of an economic recession. Given the uncertain economic outlook, we believe that the focus will shift to earnings stability soon.

We have taken a more cautious view on cyclical infrastructure; trimming our exposure and reinvesting in infrastructure that is less exposed and reliant on economic growth. We believe that overall market returns will be more subdued, making selectivity key. It is down to individual companies to drive growth from here. We focus on the quality of the income stream and prudent balance sheet.

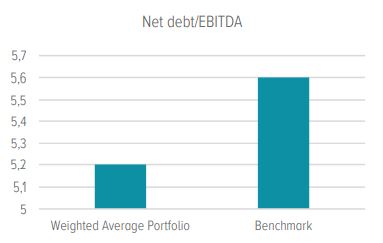

Short-term refinancing risk

Since the Great Financial Crisis, listed infrastructure has enjoyed the tailwinds of a falling cost of capital, creating room for interest cost savings and allowing for accretive inorganic growth by issuing cheap debt to finance acquisitions. As the yield curve inverted and yields increased significantly, we see the potential for short term debt refinancing risk in the sector. The infrastructure subsectors are heterogenous and so is the financing structure of the companies, making bottom up analysis even more relevant in this environment.

Higher real rates also result in higher interest expenses, mainly impacting companies with high leverage and short-term refinancing requirements. In addition to the direct impact, some sectors will have to deal with the indirect impact as financing costs are a pass-through, but will impact affordability of customers and with that future growth opportunities.

As interest rates rise, both interest rate coverage and refinancing schedules are key. We are keeping these two elements in focus in the strategy, and position our investments towards a high level of interest rate coverage and moderate re-financing needs in the short run.

Graph 2: Global Listed Infrastructure vs Real Rates

Source: Kempen, FactSet, Oct-22

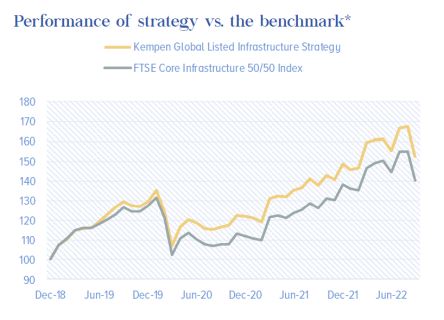

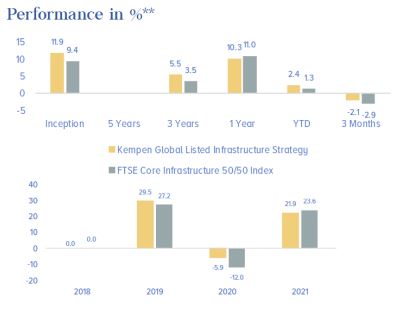

Performance update

Our strategy is down 2.1% in Q3, outperforming the index by 80bps. As a result, in the first nine months of 2022, the strategy was up 2.4% (gross, EUR), whilst global equities were negative (MSCI world all country index -13% in EUR). This illustrates the defensiveness of the sector and positive diversification benefits of the asset class in an investors’ portfolio.

Year-to-date, the strategy has been ahead of its benchmark, FTSE Global Core Infrastructure 50/50 (1.3%). Since its inception more than 3 years ago, the strategy is clearly ahead of its benchmark (11.9% gross annualised vs. 9.4%).

On a stock level

In Q3 of 2022, Cheniere (+33%), contributed significantly to our performance due to higher natural gas prices given the energy crisis. The company increased its guidance again. Two other companies that contributed were 1) Rumo (+21%) as the performance on its Brazilian rail network was strong – driven by agricultural exports, and 1) West Japan Railway (+12%) benefited good set of results and from the announcement by the Japanese government that all travel restrictions will be lifted, and it will go back to pre-COVID rules.

The most noticeable negative relative contributors were 1) Jiangsu Expressway (-15%), was impacted by the sentiment on Chinese growth and lockdowns 2) Malaysia Airports (-14%) reported still a loss in the summer as traffic has not yet recovered (international traffic stood at 35% of 2019 levels in July), and regulatory uncertainty and 3) CSX (-19%) as it was impacted by strikes, ongoing rail service issues, while CEO retired earlier than expected – raising questions about the company’s operational performance going forward.

Source: Kempen, Factset, BNP. Data as at 30/9/2022. The figures are gross performance, the effect of management fee and charges is not included. The level of the applied fees and charges will depend on the applied product structure and will have an effect on the net performance.

* The value of your investment may fluctuate. Past performance is no guarantee for future results.

** 2 January 2019 - 30 June 2022, annualised figures.

This document is prepared by the fund managers of Kempen (Lux) Listed Infrastructure Fund (‘the Fund’), managed by Kempen Capital Management N.V. (‘KCM’). The views expressed in this article may be subject to change at any given time, without prior notice. KCM has no obligation to update the contents of this article. As asset manager KCM may have investments, generally for the benefit of third parties, in financial instruments mentioned in this article and it may at any time decide to execute buy or sell transactions in these financial instruments.

This document is prepared by the fund managers of Kempen (Lux) Listed Infrastructure Fund (‘the Fund’), managed by Kempen Capital Management N.V. (‘KCM’). The views expressed in this article may be subject to change at any given time, without prior notice. KCM has no obligation to update the contents of this article. As asset manager KCM may have investments, generally for the benefit of third parties, in financial instruments mentioned in this article and it may at any time decide to execute buy or sell transactions in these financial instruments. This document does not contain investment advice, no investment recommendation, no research, or an invitation to buy or sell any financial instruments, and should not be interpreted as such.

This document is based on information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. The views expressed herein are our current views as of the date appearing on this article. This article has been produced independently of the company and the views contained herein are entirely those of KCM.

Disclaimer

Kempen (Lux) Global Listed Infrastructure Fund (the “Sub-fund”) is a Sub-fund of Kempen International Funds SICAV (the “Fund”), domiciled in Luxembourg. This Fund is authorised in Luxembourg and is regulated by the Commission de Surveillance du Secteur Financier. Kempen Capital Management N.V. (KCM) is the management company of the Fund. Kempen is authorised as management company and regulated by The Netherlands Authority for the Financial Markets. The Sub-Fund is registered under the license of the Fund at The Netherlands Authority for the Financial Markets.

The information in this document provides insufficient information for an investment decision. Please read the Key Investor Document and the prospectus. These documents as well as annual report, semi-annual report and the articles of incorporation of the Fund are available free of charge at the registered office of the Fund located at 6H, route de Trèves, L-2633 Senningerberg, Luxembourg and on the website of Kempen (https://www.kempen.com/en/asset-management).

The Sub-Fund is registered for offering in a limited number of countries. The countries where the Sub-Fund is registered can be found on the website. The value of your investment may fluctuate. Past performance provides no guarantee for the future.

There’s a saying in Dutch, Kom verder, it means many things and it’s our business philosophy. It captures the way we work with clients but also the way we steer our investee companies to deliver shareholder value through active engagement.

Capital at risk. The value of investments and the income from them can fall as well as rise, and investors may not get back the amount originally invested. Past performance provides no guarantee for the future.