The Dividend Letter: Times are changing

High inflation and increasing interest rates are a problem for equities, especially for those companies where valuations are sky-high and cash flows are far away in the future. The situation is different for dividend stocks. By selecting companies with strong cash flow generation, solid capital allocation and attractive valuations, the Kempen dividend strategies seek to pick stocks that tend to perform well in this environment.

If the stock market development so far is an indication for how the rest of the year will unfold, it will be a strong year for dividend investors. Our strategies are performing well relative to the benchmark year-to-date1. Growth stocks are struggling more than dividend stocks. While the current situation in Ukraine is creating a lot of uncertainty, we expect the high inflationary environment to persist for several reasons.

Structural sources of inflation

Energy is an important sector to discuss, given that almost every other good in the world has energy as an input cost. Monetary easing following the GFC caused a boom in shale oil. Without the risk seeking nature of investors, caused by lower interest rates, the risky and speculative drilling in shale oil basins would arguable not have been possible. Rising supply of US shale oil caused the oil market to collapse in 2014. Oil remained in a bear market until the Covid-19 pandemic, when oil prices even went negative for a brief period of time. This prolonged bear market has caused significant underinvestment in the oil and gas industry. This is further exacerbated by a more environmentally-aware investor who is often unwilling to invest in this industry.

Meanwhile, demand is growing on the back of emerging markets, where increasing prosperity leads to higher per-capita energy consumption. We believe energy prices will remain high for the coming years, until we either see a significant pickup in investments in traditional oil and gas, or a sharp drop in demand. This in turn will work through on many other goods and services.

This multi-year thesis of underinvestment gets overshadowed by the current situation in Ukraine. While the situation is volatile, this could lead to further energy shortages as Russia is 11% of global petroleum supply2. There is also a near-term question mark related to Iran, which is currently under economic sanctions. Lifting of those sanctions could in the short term ease inflation.

Temporary sources of inflation

A more temporary example is the automotive industry. Chip shortages, resulting predominantly from Covid-19 pandemic related disruptions, caused auto production to only slightly improve in 2021 versus 2020 and still remain around 15% below 2019 levels3. At the same time demand increased after Covid-19 shutdowns and the pandemic made people hesitant to commute with public transport or shared vehicles.

Automotive manufacturers benefit from the increased pricing power that comes with demand outpacing supply. After all, the car dealer does not have to give a customer $1000 worth of free upgrades to sell a car. This is a considerable uptake in profit for a company that typically earns $2k-$4k per car. Car manufacturers have also prioritized the production of higher margin models, such as SUVs. However, as the tightness in the industry is caused by temporary reasons, investors should not overstay their welcome. Instead, a recovery in automotive production volumes will probably benefit the automotive supply chain, such as tire manufacturers.

Receivers of inflation

High inflation can hit profits hard when companies cannot pass on the higher input costs and operating expenses to customers. This is why we have a preference for companies with pricing power. Understanding this pricing power comes down to following supply and demand of various goods. What matters is figuring out what shortages are caused by more structural reasons and investing in the companies that can provide those scarce goods. Scarcity is what provides them with their pricing power.

Consumer goods companies with strong brands in attractive product categories is an example of where there is pricing power. We believe these companies can pass on cost inflation to their customers and maintain their cash flow, without giving up market share. As these safe havens have underperformed the broad market in recent years, their valuations have also become more attractive.

Rising rates

To keep inflation in check, the economy needs to be cooled down, which is done by tightening monetary conditions. Therefore, high inflation leads to higher interest rates. Rising interest rates are mainly putting pressure on the valuation of companies with cash flows that lie in the distant future. It is not surprising that the stock price of many growth companies have decreased sharply when rates rallied. The companies that we select are much less sensitive to interest rates, since they generate sufficient cash flow now and in the near term to pay dividends.

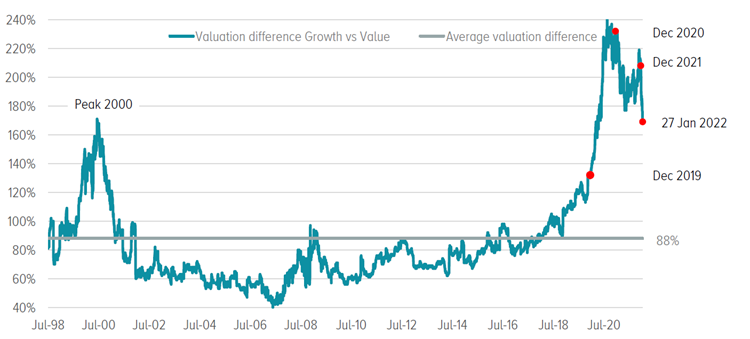

The Kempen dividend strategies focus on stocks with a margin of safety relative to their intrinsic value. Many of these stocks are within the value category. Growth stocks typically trade at a premium, justified by their higher growth. But the current valuation difference is extreme and in our opinion inflated by low interest rates. Even after the January dip for growth stocks. There is enough room for value stocks to outperform before the gap is closed.

Figure 1: average valuation difference based on PE, PC, PB, Div. Yield of MSCI world growth vs. MSCI world value

Source: Bloomberg / Kempen Dividend Team. Period March 1998 –January 27, 2022

A specific sector that tends to benefit from higher interest rates is the financial sector. For years, banks and insurers have suffered from extremely low to negative interest rates. Now the tide has finally turned for them. The share prices of banks have also rebounded because they have resumed dividend payments.

Multi-year trends

It is important to realize that the described phenomena come in waves that typically last many years. Companies such as an automotive manufacturer or energy producer are capital intensive. Many have faced years of underinvestment as investors were busy chasing the latest unicorn tech company. For scarcities to disappear, more investments are needed. However, higher interest rates will have the exact opposite effect; they make further investments in capital intensive industries less likely.

Furthermore, share prices of many of these companies are still subdued. With share prices trading at low earnings multiples, companies are more likely to prioritize share buybacks and acquisitions over investments in new capacity. This arguably prolongs the current situation of scarcity.

We believe that the mismatch between supply and demand is not easily solvable and we would not be surprised if inflation persists for longer. The Kempen dividend strategies are well positioned to benefit from the various multi-year trends. We see many reasons to continue to invest in companies that are attractively valued and pay a stable dividend.

1. Kempen. Performance after costs for the period 31 December 2021 –28 February 2022. The value of your investment may fluctuate. Past performance is no guarantee for future results.

2. OPEC Monthly Petroleum Report December 2021.

3. IHS Markit

The authors

Roderick van Zuylen

There’s a saying in Dutch, Kom verder, it means many things and it’s our business philosophy. It captures the way we work with clients but also the way we steer our investee companies to deliver shareholder value through active engagement.

Capital at risk. The value of investments and the income from them can fall as well as rise, and investors may not get back the amount originally invested. Past performance provides no guarantee for the future.