The Dividend Letter: Read between the lines

Companies often do not fit in the box we put them in. Grouping companies based on geography or industry classifications is common and useful. It helps to keep an overview of a portfolio and allows for comparing similar companies. While it is valuable, it is also a simplification.

Business operations often span multiple countries and industries that may change over time. Take Amazon or Walt Disney – is the former really only an American retailer and the latter an American media company?

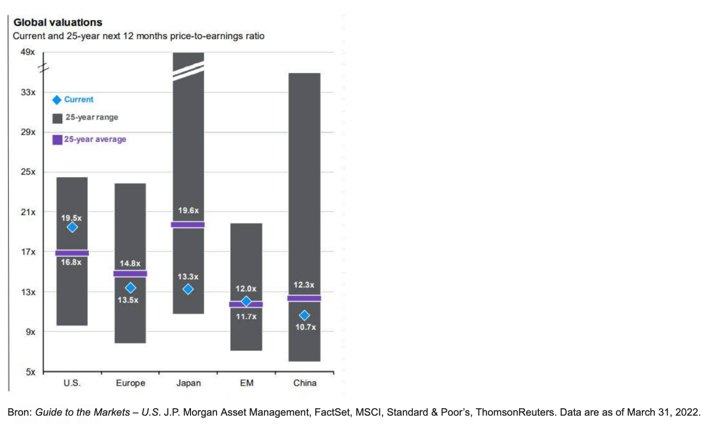

To put those examples in a broader perspective, the graph below shows the difference between the geographical split of the MSCI world when looking at the country of listing compared to the underlying companies’ revenue exposure. The regional revenue distribution of the MSCI World is less dominated by North America and more skewed to Asia than the distribution based on country of domicile. When thinking about the real exposure of companies, in our view it is more relevant to look at the mix of underlying revenue and profit streams than merely where a company is domiciled.

Figure 1: MSCI world developed regional and GEORev allocation

Following the invasion of Russia in Ukraine, it appeared that investors chose to “sell first, ask questions later” as they looked to reduce their headline exposure to Europe. Although markets declined globally, Europe took the biggest hit. Part of that is justified, as the brunt of the impact of the conflict will be felt in Europe.

But looking a layer deeper, it is clear that in some cases the baby was thrown out with the bathwater. A European stock is in many cases a globally operating company. For investors it should matter more where a company generates its profits than where its stock is listed.

Compare Procter & Gamble and Unilever for example. A North American and a European company, which both sell branded consumer goods globally. Their geographic footprint in terms of revenue is similar, with roughly 20% of revenue generated in Europe for example. Between February 23rd, just prior to the start of the war in the Ukraine, and March 31th Procter and Gamble outperformed Unilever by over 10% in Euro's.

While there are some differences between the companies, there was no company specific news flow to warrant the difference in performance over this time frame. It appears to be driven entirely by market flows as investors reallocated capital from Europe to North America. As a result, the dispersion in valuation between the companies, which was already high, widened further. It is an interesting observation that investor seem to be willing to pay a much higher multiple for similar earnings simply because one company is listed in the U.S. while the other is listed in Europe.

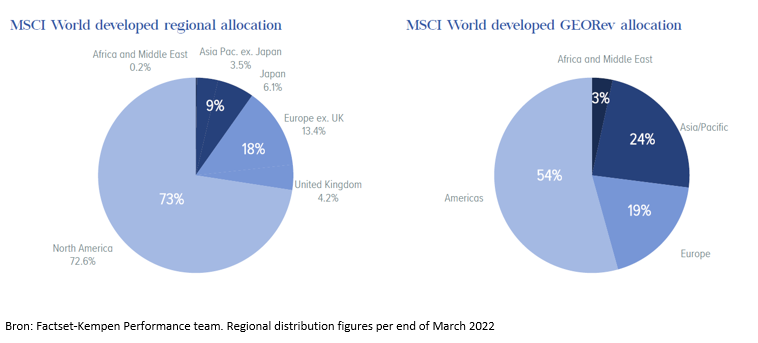

This example fits in with a broader observation. Historically, the U.S. stock market is more expensive on a price-to-earnings multiple basis than the European market. However, the current difference is very large. The U.S. market is even more expensive than its 25-year average, while the European market is below its own historical average. There are fundamental reasons why the US market demands a valuation premium. It currently has a more robust economy, capital allocation is generally better and regulation is more pro-business. However, as the example above shows the difference in valuation is not always justified when looking at the company fundamentals.

Figure 2: Global valuations

For active, fundamental investors it is about knowing the underlying company instead of just its stock. This is where they can make the difference, especially in adverse times. While there is a lot of uncertainty and volatility in the market, focusing on the fundamental drivers helps to find attractive investment opportunities.

The authors

There’s a saying in Dutch, Kom verder, it means many things and it’s our business philosophy. It captures the way we work with clients but also the way we steer our investee companies to deliver shareholder value through active engagement.

Capital at risk. The value of investments and the income from them can fall as well as rise, and investors may not get back the amount originally invested. Past performance provides no guarantee for the future.