Kempen Global Listed Infrastructure: Outlook 2023

STRATEGY REVIEW AND OUTLOOK 2023

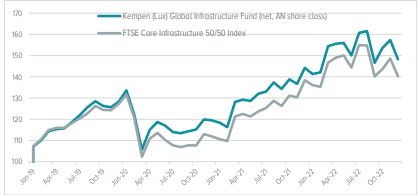

The strategy has now successfully reached its fourth year since we launched it in 2019. Since then, the world and the financial markets have gone through turbulent times – from a global pandemic to a war at the doorstep of Europe, from an energy crisis to inflation and interest rates hikes. As a result, markets have been volatile but with volatility comes opportunity. Since inception, we generated more than 10% annualized return (net, I share class), c.150bps above our benchmark. We were also able to exponentially grow our AuM each year to just shy of EUR 160m at the end of 2022. A special thanks to all of our investors for their support. We are satisfied about what we have achieved for our clients, and are as committed as ever to build our track-record a lot further from here.

Figure 1: Kempen (Lux) Global Infrastrructure performance (net, AN class) since inception

Source: Kempen, Factset, BNP, Jan-23

2022 was an eventful year, and infrastructure was at the heart of these events. Let’s look back at what happened and how the asset class was impacted.

The year 2022 started off with the invasion of Ukraine from Russia that led to a complete disruption of the energy system in Europe, and its ripple effects were felt across the globe. The sudden shortage of cheap Russian gas led governments to look for other sources of energy and increase the import of LNG via ships and ports, boosting the deployment of renewable energies and unfortunately restarting coal-fired plants to face the crisis and to avoid power cuts.

From the start of the year, energy security became an equally important theme as energy transition. This will not change during 2023. Our investments in US pipelines that supply gas to Europe were the key winners along with those companies with exposure to higher energy prices, namely Cheniere and Williams. Sempra Energy in the US also generated alpha given the boost to its LNG business as a result of the energy crisis.

Energy transition became even more relevant as governments realized renewable energies are the key to obtain energy independence. The European Union published the RePowerEU plan with the goal of reducing CO2 emissions by 55% (+5% from the previous plan) by increasing the 2030 goal for the share of renewables from 40% to 45%. The way to get there is through a massive expansion of the renewable infrastructure, the transformation of transmission grids into “smart” grids and the steep increase in electrification. The US soon followed with the Inflation Reduction Act, that despite the name is the single largest investment in climate and energy to put the country on a pathway to reach a net-zero economy by 2050 by boosting incentives for renewables.

The effects of the war were, and still are, numerous. For a start, it caused a humanitarian crisis and the loss of lives – where the true number may not be known for years. On the economy, the most obvious effect was a sharp increase in gas and fuel costs that impacted energy bills and put a strain on households. This led to a surge in prices not seen since the 1970s-80s. In the Eurozone, the 2022 inflation rate spiked to around 8.5% on average, after peaking at almost 11% in October, while it reached 6.5% in the US. Most of the investments we have offer inflation protection, thus demand for the companies we owned rose sharply, generating outperformance.

Ukraine is also an important supplier of wheat and grains for the world, and disruptions at its ports caused a strain of supply of food. The main impact was felt in the poorest countries, that faced costs of importing food that they could not afford. Global famine increased as a result. For this new theme of food security, we quickly gained exposure to Rumo, a Brazilian railway company that transports agricultural products towards ports for exports. Volumes grew immediately due to substitution effect from Ukraine.

As a result of inflation, central banks started increasing interest rates to combat inflation, with the goal of bringing it down to around 2% as it is their mandate. It represented a complete pivot with respect to the monetary policy easing pursued over the last decade. Negative government interest rates turned positive again, and several rate hikes followed, making debt financing and refinancing suddenly more expensive. The US 10Y treasury bond rate was up to almost 4% at the end of 2022, up from 1.5% at the start of the year, while the German rate was raised from -0.2% at the end of 2021 to +2.6%. The beauty of investing in infrastructure is that higher financing costs can be pass through to consumers with limited delay, thus not meaningfully impacting our companies.

As a result of the above events, global listed infrastructure reported a positive +2.8% absolute return (net, I share class) against the global market that recorded a negative -13% (MSCI World Index). Infrastructure assets generally benefit from full inflation protection embedded in concessions and contracts, plus exposure to gas transportation between the US and Europe and to commodity prices proved to be very beneficial in 2022. Finally, the defensiveness characteristic of infrastructure and the visibility on long term cash flows give the sector resiliency during downturns and make it a place where to hide during a recession.

THE ROAD AHEAD IN 2023 – STRONG DEMAND OUTLOOK FOR THE INFRASTRUCTURE SECTOR

New Year’s Eve has passed but 2023 will see the effects of many trends initiated in 2022 continuing into the new year. Geopolitics will be at the forefront of the headlines through the year. We hope for a peaceful and rapid resolution of the war in Ukraine. However, this does not seems to be happening any time soon, given the build of arms into the region. Therefore, the energy market – linked to the supply of Russian gas - is expected to remain tight also throughout 2023. However, winter so far has been mild, with temperatures above the average seasonal standards. As a result, gas consumption in Europe was reduced by as much as 20% (August-November) with respect to the previous year. As such, storages are full above seasonal standard and there is widespread conviction that no gas shortages and thus imposed outages are needed.

The warmer winter and the filled storages are pushing gas and electricity prices down to lower level with respects to the peaks of summer 2022, but they are still at elevated levels compared to 2021. Expectation is that, unless Russian gas starts flowing to Europe again, power prices will remain elevated compared to the past and possible spikes will be linked to weather conditions. Exposure to commodity pricing will generate more alpha if the weather conditions will worsen going forward. Otherwise, hedging of power prices will protect our companies from decrease in energy costs.

Inflation is coming down from the peak levels of the second half of 2022, it is still far away to the 2% target of central banks. According to central bankers, the tapering of tightened monetary policy will not happen soon and it will not revert back to where we were before the crisis. We expect the increase in interest rates to slow down going forward. Infrastructure assets are generally able to pass through to customers any increase in financing costs, thus not recording any slowdown of investments coming from higher financing costs, differently from other sectors.

The increase in interest rates reduces inflation by cooling off the global economy, and the great uncertainty about 2023 are all around recession risks. The 2023 recession is by far the most expected and foreseen recession ever witnessed. However, as much as you can expect something, the experience can still hold surprises. Several market commentators have already been flagging the coming recession. No one will know the shape or duration of the recession until after it’s over, and the key value add for fund managers is to check the robustness of their investments in a recession scenario.

Lastly, 2022 ended with the sudden release from lockdown of more than 1.4bn Chinese people, that for almost 3 years (1016 days) have been forced to intermittently be locked into their homes under extremely strict quarantine measures. The sudden U-turn of the Chinese government and the reopening of the Chinese economy is going to have a very big impact on the markets. Implications across infrastructure will be felt initially in the transportation sectors (pent up demand for travel), and more enduringly on energy consumption as economic activity in China re-awakens. Globally, supply chain should slowly become less tight and trade should resume at normalized levels.

As we have learnt in Europe over the last couple of years, a reopening is never smooth and it will be have several bumps on the road but ultimately the way seems tracked.

OUTLOOK BY INFRASTRUCTURE SECTOR

Utilities: We are in the race of energy security + energy transmission

The invasion of Ukraine from Russia has had the ultimate result of increasing countries’ pressure to obtain energy security and avoid the reliance on hostile countries that could weaponize energy to pursue their expansion goals. In the short term, European countries imported gas (LNG) and switched back on their coal fired plants, prioritizing energy supply to decarbonization. Going forwards, the development of renewable energies (solar, wind, hydrogen, biomass) and nuclear, will be the key priority in the most developed nations to reach carbon neutrality targets.

Price caps on gas imports and embargoes on imports of oil were applied in the course of 2022 and are mostly here to stay in 2023. However, despite the efforts to control the peaks in energy prices, the new “normal” pricing of around 70-80 euro/MWh in Europe is high enough to remunerate renewable projects. On top of this, the unit price of production of renewable assets was recording a steady decline until recent supply chain constraints generated inflation also in the space (for example the material costs for wind farms increasing). Going forwards, we expect a return to falling material costs when inflation will be under control – thus leaving space for margin accretion for renewable operators. The IRA Act in the US is already pushing in this direction by subsidizing the costs for developers. We have built exposure to renewable energies and utility companies across the globe.

We also see the great potential of margins expansion coming from the restart of nuclear reactors by specific utility companies. The cost of producing energy through nuclear reaction is cheaper than producing it by buying gas or coal. The restart of nuclear reactors will be the catalyst of strong margin expansion and we built a position in that direction by buying a Japanese company that is expected to restart 5 reactors in 2023 (out of 7 they own, Kansai Electric Power). Our investments in nuclear restarts directly contribute to Japan’s climate goals.

The boost in money spent in renewable developments must be matched by a greater amount spent in grid development and expansion – the renewables projects are often away from urban population centers, and power needs to be transmitted to where it is needed. For every euro spent in renewables, more than one euro must be spent in the grid. The beauty of investing in grids lays in the fact that grid are regulated businesses, thus more CAPEX they spend on the assets, the higher the remuneration that the grid operator generates. We have just entered a super-cycle of CAPEX in the grid space and investing in infrastructure allows to capture this growth. Terna and National Grid are two European names that we own that are deploying substantial CAPEX to this goal.

From the reopening of the Chinese economy we expect a longer term positive impact on the power needs of China as economic activity returns, and we had started building up exposure to Chinese utilities (mainly in gas distribution across China) that will power this expected growth.

In conclusion, we expect the utilities sector to be the center of billions of investments also in 2023 to pursue energy security and energy transition goals. Fortunately, these two goals go in the same direction, and we will see a strong push throughout the year.

Transport: China’s back and food security exposure

Transport infrastructure consists of toll roads, rail (freight & passenger), airports and ports. Historically, transportation has always been considered a defensive sector, with some differences within the sector. On short distance transport - given the high inflation on plane tickets, we are currently more bullish on toll roads than we are on short-haul flights. For this, we added to our position in Vinci, a French toll-road operator.

The ‘coming out of lockdown’ theme played out well last year as passengers volumes in Europe and US are back at pre-Covid levels. Now, great potential comes from the reopening of China. Three years of lockdowns had mixed effects on the population’s wealth, but the middle class was able to save (no leisure in terms of travelling, or restaurants) and we expect ‘revenge travel’ to pick up. We expect this to play out internationally as much as locally. To benefit from this, we are exposed to airports in destinations popular amongst Chinese tourists (Malaysia Airport in particular) as well as toll-roads in one of the richest province in China (Jiangsu Expressway). The toll-road is located in a very industrial area and will thus also benefit from increase in industrial production as goods are transported via trucks (on the toll-road) to the ports.

When the war broke out in Ukraine, food security became an issue, and we looked for the countries that would could have benefitted the most by taking up food production. Brazil was the top pick and we built a position in Rumo, a local railway that connects agriculture town with the port areas. The trade proved fruitful and we see this theme continuing in 2023.

Given the fears of a looming recession, we are cautious about investing directly in ports – especially where the goods moved are more discretionary items.

Digital: Long term play with short term headwind

Digital infrastructure (datacenters and telecommunication towers) proved to be very resilient and defensive thanks to the inflation protection embedded in the long term contracts signed by the operators. Interest rates hikes are however a headwind for the sector now. Digital infrastructure is characterized by high duration and is closely associated to real estate (you buy a piece of land, build a telecommunication tower on top and rent out the space to occupants), and an increase in interest rates has an immediate negative effect on the cost of debt and value of the asset. Long term we see digitalization and the roll-out of 5G as secular trend in the sector, supporting investments in the space and ultimately valuations. Short term however interest rate hikes will remain a headwind. The ’return to the office’ (as opposed to working from home) theme is not incrementally favorable for the space either.

What changed from the past is mostly around the consolidation within the space. M&A will remain a source of inorganic growth but it is expected mostly through the acquisition of smaller companies. Large companies are now redirecting their efforts towards cost control and deleveraging more than extensive M&A (Cellnex is a good example of this, and we own the company). What we expect going forward are potential privatizations of some of companies in the space, there seems to be interest from private funds in this direction. We remain focused on picking the companies that are better position for the future given their valuation and growth opportunities. Any surprise coming for a potential acquisition will be considered cherry on top - if the target is one of our companies.

CONCLUSION

Infrastructure is at the core of the change for our economies and nations to be fit for the future. It is a sector defensive in nature but on a pattern of sustained growth. We expect inflation concerns to continue in the first half of 2023 and our investments offer inflation protection. Secular trends of decarbonization, electrification and digitalization offer opportunities for those infrastructure companies that can be leaders in those transitions – and we look for those trajectories every day. Energy security started off as a challenge and soon became an opportunity to generate returns. Investing in infrastructure enables the investor to gain exposure to this growth and capture the opportunities that the market provides. We are convinced that the listed infrastructure will offer appealing opportunities, and our only certainty is that our team will be there hunting for alpha.

The Kempen (Lux) Listed Infrastructure Fund currently holds shares in the companies mentioned. The views expressed in this presentation may be subject to change at any given time, without prior notice. Van Lanschot Kempen Investment Management NV (VLK Investment Management) has no obligation to update the contents of this presentation. As asset manager VLK Investment Management may have investments, generally for the benefit of third parties, in financial instruments mentioned in this document and it may at any time decide to execute buy or sell transactions in these financial instruments.

The information in this document is solely for your information. This document should not be considered to constitute an investment recommendation and it is not intended as an offer or a solicitation to buy or sell any financial instrument mentioned in this document. This document is based on information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. The views expressed herein are our current views as of the date appearing on this document. This document has been produced independently of the company and the views contained herein are entirely those of VLK Investment Management.

Kempen (Lux) Listed Infrastructure Fund (the ‘Sub-fund’) is a sub-fund of Kempen Investment Fund SICAV (the ‘Fund’), domiciled in Luxembourg and regulated by the Commission de Surveillance du Secteur Financier. Van Lanschot Kempen Investment Management NV (VLK Investment Management) is the management company of the Fund. VLK Investment Management is authorised as a management company and regulated by the Dutch Authority for the Financial Markets (AFM). The Sub-Fund is registered under the license of VLK Investment Management at the AFM. This information constitutes an insufficient basis for an investment decision. You should therefore read the key information document and the prospectus. These documents, as well as the articles of association, the annual report and the semi-annual report, can be obtained free of charge from the Fund’s offices at 6C. route de Trèves, L-2633 Senningerberg, Luxembourg, and on the website of VLK Investment Management (www.kempen.com/en/asset-management). The value of your investment may fluctuate. Past performance provides no guarantee for the future. The Sub-fund is registered for offering in a limited number of countries. The countries where the Sub-fund is registered are listed on the website of VLK Investment Management (www.kempen.com/nl/asset-management).

Disclaimer

Kempen (Lux) Listed Infrastructure Fund (the ‘Sub-fund’) is a sub-fund of Kempen Investment Fund SICAV (the ‘Fund’), domiciled in Luxembourg and regulated by the Commission de Surveillance du Secteur Financier. Van Lanschot Kempen Investment Management NV (VLK Investment Management) is the management company of the Fund. VLK Investment Management is authorised as a management company and regulated by the Dutch Authority for the Financial Markets (AFM). The Sub-Fund is registered under the license of VLK Investment Management at the AFM. This information constitutes an insufficient basis for an investment decision. You should therefore read the key information document and the prospectus. These documents, as well as the articles of association, the annual report and the semi-annual report, can be obtained free of charge from the Fund’s offices at 6C. route de Trèves, L-2633 Senningerberg, Luxembourg, and on the website of VLK Investment Management (www.kempen.com/en/asset-management). The value of your investment may fluctuate. Past performance provides no guarantee for the future. The Sub-fund is registered for offering in a limited number of countries. The countries where the Sub-fund is registered are listed on the website of VLK Investment Management (www.kempen.com/nl/asset-management).

Contact:

There’s a saying in Dutch, Kom verder, it means many things and it’s our business philosophy. It captures the way we work with clients but also the way we steer our investee companies to deliver shareholder value through active engagement.

Capital at risk. The value of investments and the income from them can fall as well as rise, and investors may not get back the amount originally invested. Past performance provides no guarantee for the future.