Impact investing

From goal to measurable result

We use our extensive experience in fiduciary advice and manager selection to create impactful investment portfolios for clients. With the aid of specialist external managers, we translate their chosen impact themes into tangible objectives and effective solutions. To do so, we take advantage of our many years of expertise in alternative and illiquid investments.

Go to

Why impact investing?

Fiduciary advice

We translate our clients’ wishes into tangible objectives and solutions.

Sustainable goals

Selection of themes, investable KPIs and asset classes.

Local Impact

Investors can also make a positive contribution to solutions ‘close to home’, right here in the Netherlands. We offer several unique opportunities to invest locally with impact.

Impact solutions

Alternative investments in private markets are excellently suited to impact investing. We select the most suitable external managers for our clients.

Private global impact solution

A ready-made private markets impact portfolio. This off‑the‑shelf solution targets climate & energy, circular economy, SME development and basic needs worldwide, with clear impact reporting and a focus on measurable real‑world outcomes.

Working together to create an integrated impact portfolio

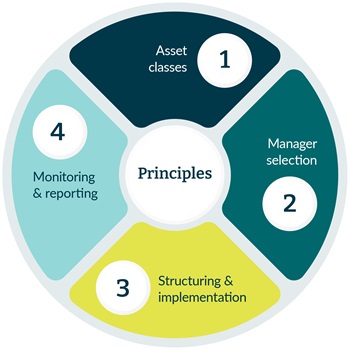

5D investing: an integrated approach

Having an impact via private market asset classes

Video

The new impact investing

Impact investing is evolving. Discover how institutional investors are increasingly taking a systemic approach and actively contributing to a more inclusive and future-proof society. This video explores the latest developments in the new era of impact investing.

Article

Critical criteria for impact manager selection

When building portfolios to generate measurable positive change alongside expected returns, choosing the right fund manager is everything. We seek managers who deliver on both dimensions without compromise. This requires a full integration of financial and impact due diligence, focusing on solutions that drive true progress.

Connect with our experts

Meet the rest of our team

Discover the full range of expertise and services our team offers. Visit our contact page to learn more about our dedicated professionals and how they can assist you.

Insights

Subscribe to our Insights

Make sure you never miss out on our thought-leadership or insightful events

1.

1.